Shares in American technology company Nvidia have risen sharply during the past year. The increases have given the company a market valuation of more than $3 trillion.

Last week, the price of Nvidia’s shares made it the world’s most valuable company for a short time, ahead of Microsoft and Apple. On June 20, Nvidia’s estimated market value reached $3.34 trillion. At that time, Microsoft’s market value was listed at $3.30 trillion, while Apple’s valuation was $3.22 trillion.

But Nvidia’s share price then dropped sharply, reducing the company’s valuation. Later the share price rose again, including a five percent increase during Tuesday’s trading.

Some financial experts said the recent movements in Nvidia’s share price helped drive gains across the U.S. stock market. They noted that Nvidia has grown to become one of the largest and most influential companies on the stock market.

What path did the company take to get where it is today?

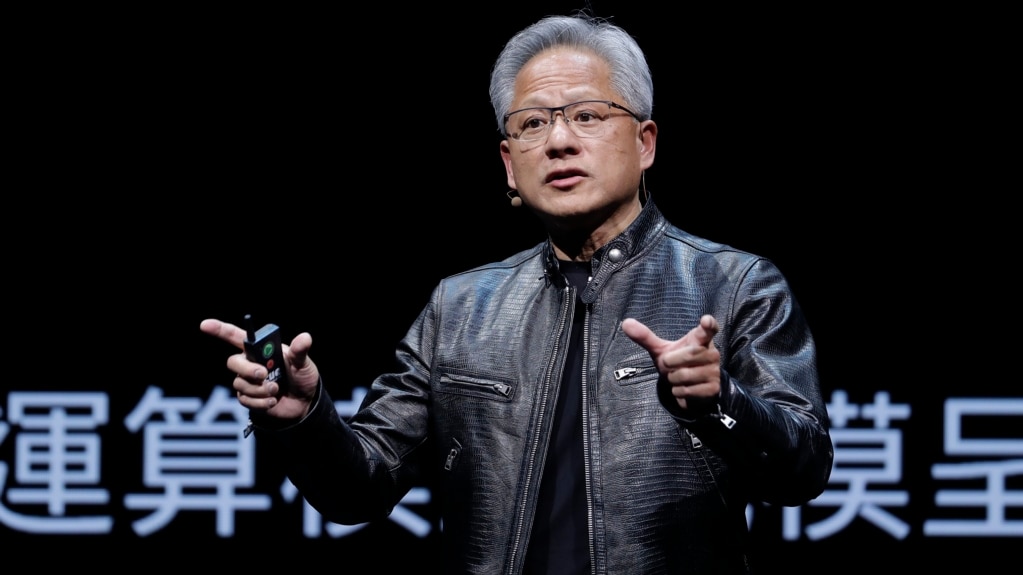

The company was formed by three engineers – Jensen Huang, Chris Malachowsky and Curtis Priem – who first discussed their ideas for the business over dinner. Their main goal was to design and build a computer chip that would make graphics used for video games faster and more realistic.

Nvidia was founded in 1993. At the time, the business centered on the production of chips built to support high-level graphics operations. This development continued and in 1999, the California-based company invented the graphics processor unit, or GPU. This move was widely seen as helping to drive a big increase in computer gaming and redefine computer graphics.

Nvidia’s business expanded during the COVID-19 pandemic when gaming increased in popularity while people were under stay-at-home orders.

Today, the company is centered on producing specialized computer chips designed to support artificial intelligence (AI) operations. The chips run powerful processing systems used to train AI systems. These tools – such as OpenAI’s ChatGPT, Google’s Gemini and Apple’s Apple Intelligence — are trained and developed on huge amounts of internet data.

Huang currently serves as Nvidia’s chief executive officer (CEO). During a conference call last month with industry experts, he predicted that companies using Nvidia chips would be looking to build new data centers called “AI factories.”

Huang added that training AI models is becoming a faster process as the systems learn to become “multimodal.” He said this means they are able to understand text, speech, images, video, and other forms of data and can also “reason and plan.”

“People kind of talk about AI as if Jensen just kind of arrived like in the last 18 months, like 24 months ago all of a sudden figured this out,” said Daniel Newman. He heads the technology research company The Futurum Group. “But if you actually go back in time and listen to Jensen talking about accelerated computing, he’s been sharing his vision for more than a decade,” Newman told the Associated Press.

Newman said Nvidia’s GPUs have played an important part in the company’s recent success by filling an immediate need for specialized AI chip products.

“They took an architecture that was used for a single thing, to maybe enhance gaming, and they figured out how to network these things,” Newman said. He added, “They basically ended up creating a market that didn’t exist, which was GPUs for AI, or GPUs for machine learning.”

Technology experts say GPUs are designed to more easily process the specific kind of math involved in AI computing. By comparison, other processing systems are built to deal with a wider range of operations, but with less efficiency.

OpenAI's ChatGPT, for example, was created with thousands of Nvidia GPUs. And Tesla CEO Elon Musk has reportedly secured GPUs from Nvidia for his startup company, xAI.

I’m Bryan Lynn.