A study by the Associated Press (AP) found that 12 countries may face economic collapse if they fail to repay foreign loans. The countries borrowed a lot of the money from China.

The AP researched the 12 countries most indebted to China. They include Pakistan, Kenya, Zambia, Laos and Mongolia. The AP found that those countries are using increasing amounts of tax revenue to pay back their debt. That money is also needed to keep schools open, provide electricity and pay for food and fuel.

Paying debt is also using up the countries’ foreign currency reserves. The countries use their reserves to pay interest on foreign loans and for several other purposes.

The 12 countries had as much as 50 percent of their foreign loans from China. Most of those countries were spending more than one third of government revenue on debt payments. Zambia and Sri Lanka have already defaulted. In finance, to default means being unwilling or unable to pay back a loan.

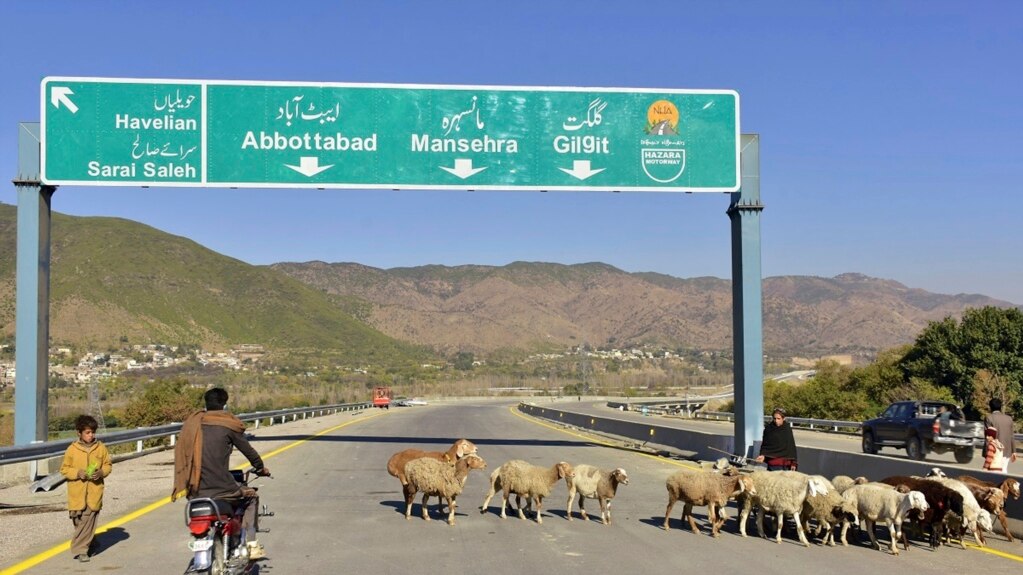

In Pakistan, millions of workers who make cloth and clothing have lost their jobs because the country has too much foreign debt. The AP said the government cannot afford to keep the electricity on and machines running.

Sri Lanka lost 500,000 industrial jobs since it chose to default on its international loans. Inflation hit 50 percent in the country. More than half the population in parts of the country has fallen into poverty.

Zambia’s foreign interest payments became so high that it had to cut spending. That included spending on healthcare and support for farmers.

In similar situations in the past, countries negotiated terms with lenders from the United States , Japan, and France to repay only part of the loans. But the AP reports that some Chinese lenders refused to make any changes with Zambia.

In November 2020, Zambia defaulted on its foreign loans. Unemployment reached its highest level in 17 years, and the nation’s currency, the kwacha, has lost 30 percent of its value in just seven months. A United Nations report estimates nearly 3.5 million Zambians are not getting enough food.

“I just sit in the house thinking what will I eat because I have no money to buy food,” said Marvis Kunda, a blind 70-year-old widow in Zambia’s Luapula Province.

In an effort to make debt payments, some countries have almost used up their foreign currency reserves, the AP said. These reserves are used for international financial exchanges, investment and to pay for imports. The AP report suggests that Pakistan and Ethiopia have only about two months left before their reserves run out.

Mohammad Tahir lost his job at a textile factory six months ago in Pakistan. He said he has thought about suicide because it is so difficult to see his family of four go to bed night after night without dinner.

“I’ve been facing the worst kind of poverty,” said Tahir.

Two other developments have made the situation more difficult. First, the war in Ukraine has resulted in increased prices for grain and oil. Second, the U.S. central bank has raised its interest rates 10 times since last year. That has resulted in higher interest rates for some foreign loans, and higher interest rates mean higher costs for borrowers.

International lending organizations, like the World Bank, say China should make it easier for borrowing countries facing problems. But China says the World Bank and the International Monetary Fund (IMF) should give better terms to borrowers.

China’s Ministry of Foreign Affairs said that all the lenders need to act under the idea of ”joint action, fair burden.”

Experts give two reasons why Chinese banks are not changing the terms of loan repayments. One is because China’s economy is already slowing. The other is that some of China’s banks must deal with bad property loans inside China.

Brad Parks is executive director of the research group AidData at the College of William and Mary in the American state of Virginia. His group has found thousands of secret Chinese loans and helped the AP in its study.

After 10 years of research, Parks’ team found at least $385 billion of hidden or underreported Chinese debt in 88 countries. Many of those countries were in bad financial condition.

Among the findings was that China issued a $3.5 billion loan to build a railway system in Laos. The loan would take nearly 25 percent of the country’s total yearly economic activity to pay off.

Ashfaq Hassan is a former debt official at Pakistan’s Ministry of Finance. He said all the lenders have to help because time is running out. Hassan said every investor in this country will have to lose money.

Parks thinks more people need to understand how China makes foreign loans. “Unless people understand how China lends…we’re never going to solve these crises,” he said.

I’m Andrew Smith. And I’m Jill Robbins.